income tax return malaysia

Last day on expiry of seven months from the date upon which the accounts are closed. The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia.

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Discover latest income tax slab rates new regime and old regime updates as per the union budget Income tax slabs rates announcements videos and more.

. 30042022 15052022 for e-filing 5. Yonhap news articles produced by building a network covering domestic supplies in various newspapers broadcasting and government departments major institutions major corporations media K-pop K-wave Hallyu Korean Wave Korean pop Korean pop culture Korean culture Korean idol Korean movies Internet media and international agreements of the Republic of. No cash value and void if transferred or where prohibited.

Follow the instructions on your return. The double tax treaty tells Mark that the UK has the main right to tax the income and that if Germany also wants to tax it then the foreign tax credit method should be used to avoid double tax. Tax Offences And Penalties In Malaysia.

If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it was earned. It is mandatory to file ITR for individuals If the gross total income is over Rs250000 in a financial year. Form 4506 Request for Copy of Tax Return PDF is used to request a copy of previously filed tax returns with all attachments.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. Complete the form. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e-filed or printed not including returns. Return Form RF Filing Programme For The Year 2021. The income tax rate for resident legal persons is 20 payment of 80 units of dividends triggers 20 units of tax due.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify.

If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. How To Pay Your Income Tax In Malaysia. An appeal must be filed within 30 days from the date of the deemed notice of assessment that is within 30 days of the date of submission of the tax return.

Partnership firms including Limited Liability Partnership LLP tax return filing Partnership firms registered or unregistered are required to file income tax returns in form ITR 5 each year. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

Mail one copy to the CRA and keep the other copy for your records. However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method. For information about your state tax refund check contact your state revenue department.

Form B Income tax return for individual with business income income other than employment income Deadline. The form and instructions are available on IRSgov. The capital gains tax in 2011 was 28 on realized capital income.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. A 5000 fee per tax return applies. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

If you and your spouse or common-law partner receive the OAS pension each of you must complete and send a return. All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income. Malaysia Last reviewed 13 June 2022 Within seven months from the date of closing of accounts.

Here are the many ways you can pay for your personal income tax in Malaysia. Offer valid for returns filed 512020 - 5312020. Dialog Minutes For Operational.

A self-assessment system of taxation for individuals is in effect in Malaysia. Completing your Old Age Security Return of Income. 30062022 15072022 for e-filing 6.

A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. The federal tax return filing deadline for tax year 2022 is April 18 2023. 1 Pay income tax via FPX Services.

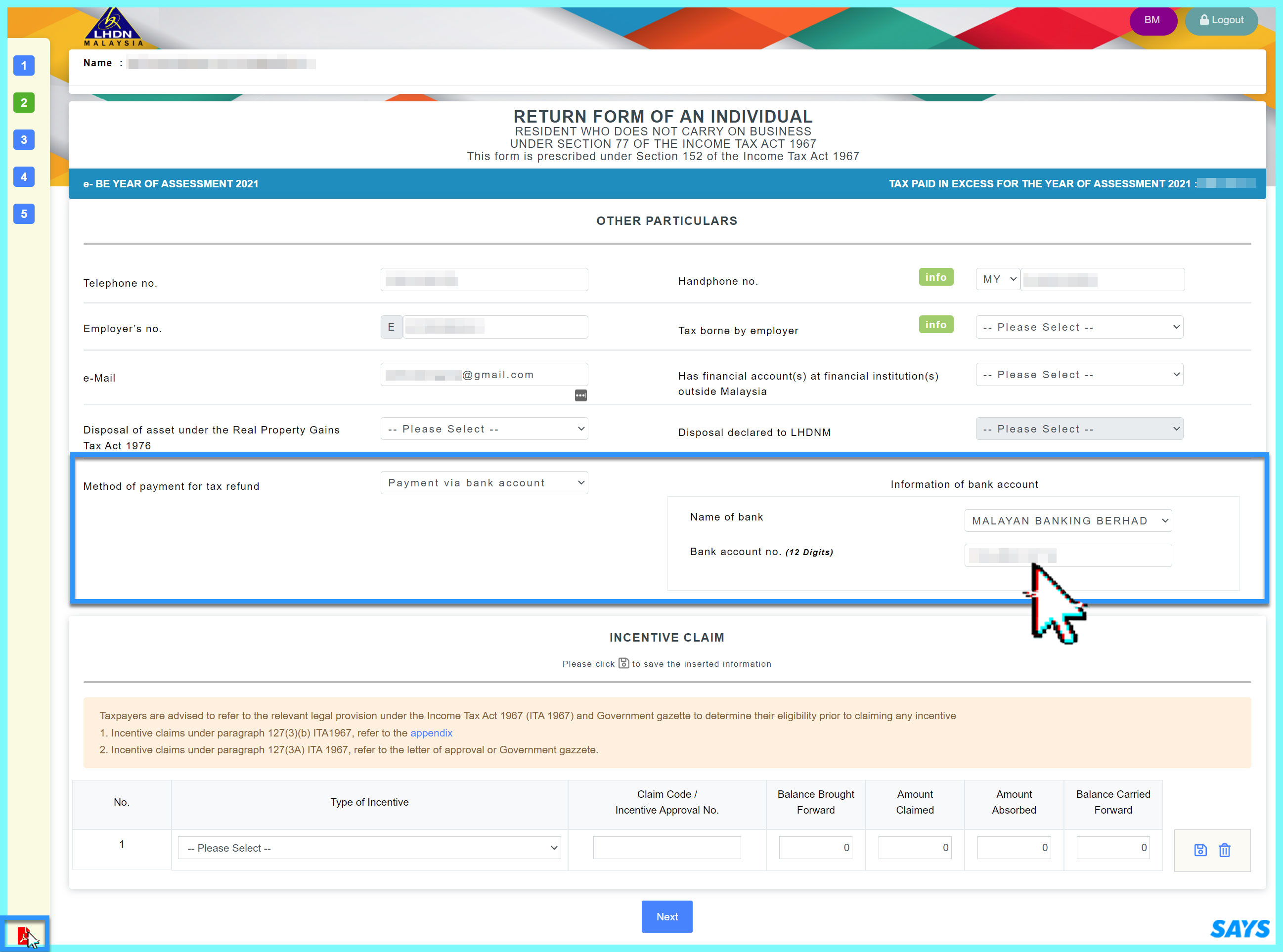

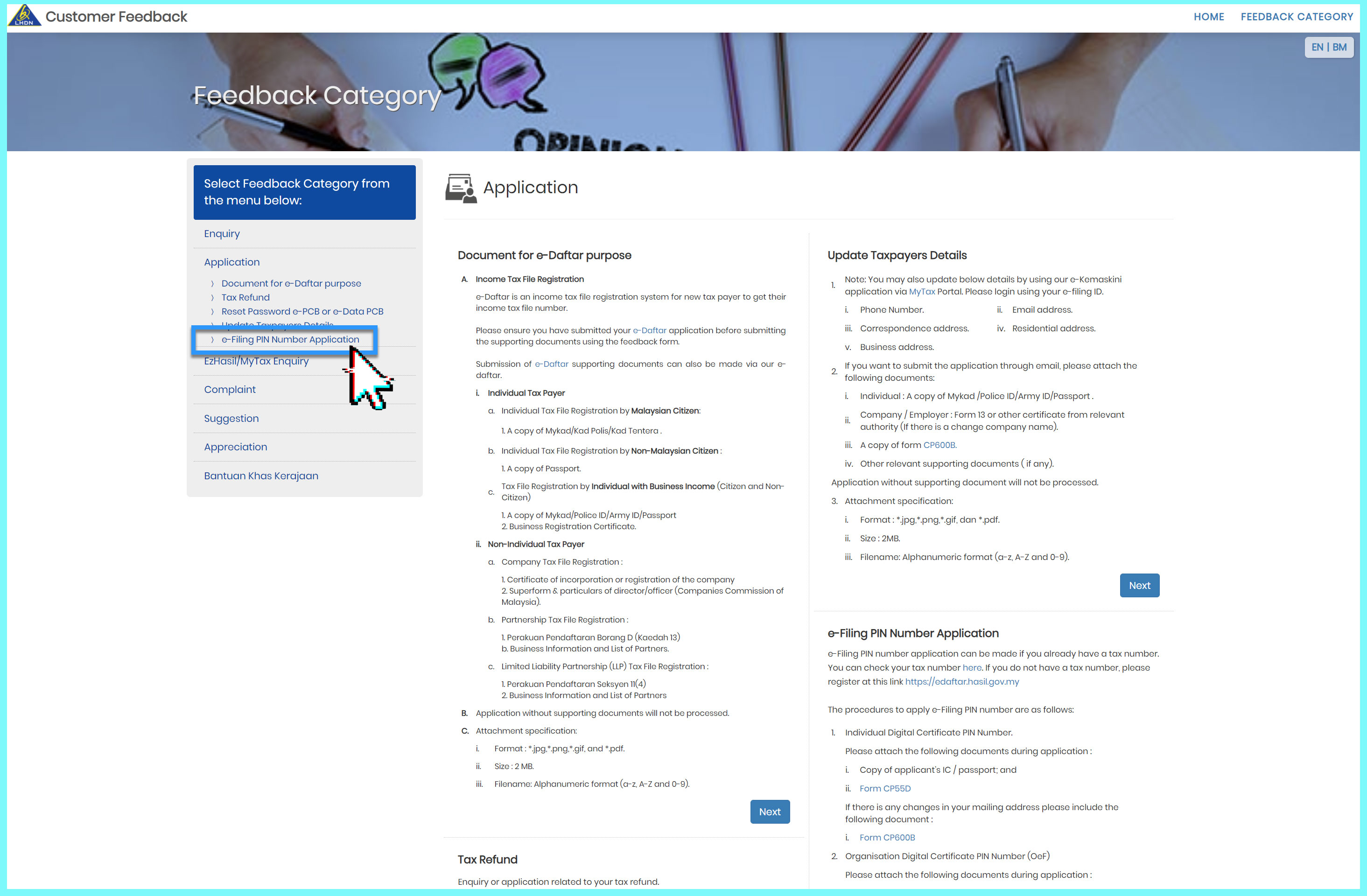

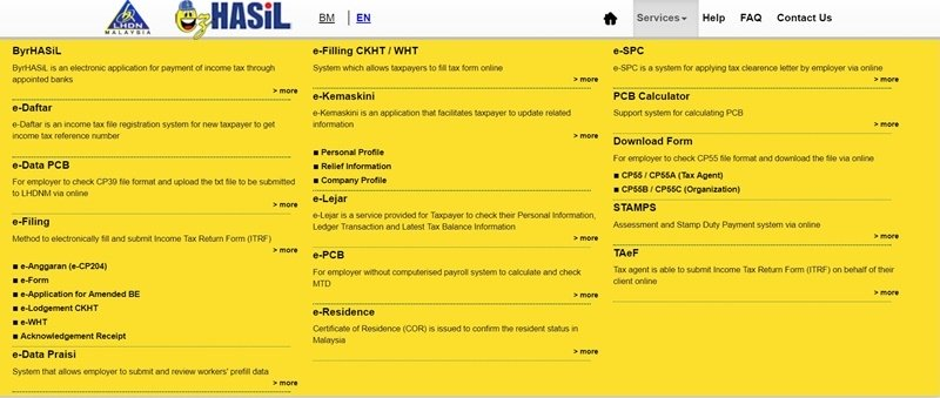

Guide To Using LHDN e-Filing To File Your Income Tax. Advance tax is paid by 12 monthly instalments. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Get information on latest national and international events more. By doing so you may receive a refund for some or.

Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen. Return Form RF Filing Programme. Sole proprietorship tax return filing The proprietorship firm can use ITR-4 for tax filing under a presumptive tax scheme.

Form P Income tax return for partnership Deadline. Now lets get started and find out whats chargeable income. Who Should Pay Income Tax.

If you missed the deadline and did not file for an extension its very important to file your taxes as soon as possible. Filing an amended tax return with the IRS is a straightforward process. Income tax return for individual who only received employment income Deadline.

Criteria on Incomplete ITRF. As a cash basis taxpayer you generally deduct your rental expenses in the. This limit exceeds Rs300000 for senior citizens and Rs500000 for super senior citizens.

Complete Form T1136 Old Age Security Return of Income. But you can still file a return within three years of the filing deadline to get your refund. With this simple and easy-to-understand Malaysia income tax guide 2022 for Year of Assessment 2021 you will be filing your tax like a whiz in no time.

Within 180 days after the end of the financial year. Read latest breaking news updates and headlines. Filing with TurboTax is fast easy and guaranteed to.

However at the time of filing an income tax return heshe opts for any tax regime. A notice of assessment is deemed served on the submission of the tax return to the tax authorities. The capital gains tax in Finland is 30 on realized capital income and 34 if the realized capital income is over 30000 euros.

If the return is not complete by 531 a 99 fee for. How To Pay Your. Form 4506 has multiple uses and special attention must be taken when completing the form for a gift tax inquiry.

Check Income Tax Slabs Tax Rates in india for FY 2021-22 AY 2023-24 on ET Wealth. Guide To Using LHDN e-Filing To File Your Income Tax. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X.

Guide To Using LHDN e-Filing To File Your Income. You qualify for the Earned Income Tax Credit EITC You may not have filed a tax return because your wages were below the filing requirement. Upon submission of an income tax return ie.

Guide To Using LHDN e-Filing To File Your Income Tax. Offences Fines and Penalties. How Does Monthly Tax Deduction Work In Malaysia.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To File For Income Tax Online Auto Calculate For You

Tax Season 11 Critical Deductions You Should Know Financetwitter

Personal Income Tax Archives Tech Arp

Robotax App Malaysia Personal Income Tax Form Be

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To File Income Tax For The First Time

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Income Tax Malaysia 2018 Mypf My

How To File Income Tax For The First Time

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Deadline For Some Income Tax Returns Remains Irb

Guide To Using Lhdn E Filing To File Your Income Tax

Malaysia Personal Income Tax Guide 2020 Ya 2019

Comments

Post a Comment